April 3, 2017 End of Rumours! लीसा उद्योग की अटकलों...

Read More- April 15, 2017

Understanding GST and its Impact on Rosin Industry

On, 6th April 2017, Rajya Sabha passed 4 bills related to GST. And it is expected that GST will be rollout on 1st July 2017. Therefore it will be a necessary thing to understand what exactly it is and how it can affect Rosin and its allied product industry.

WHAT IS GST?

Goods and Services Tax better known as GST in India, is a new and comprehensive tax to be levied on sales, manufacturing and consumption of services and goods across the nation. Referred to as one of the biggest tax reforms in the country, GST is expected to bring together state economies and improve overall economic growth of the nation.

Both the Central as well as State governments are set to impose GST on all services and goods produced, manufactured and imported in India. Exports are not subject to GST. As of now, the proposal is for two tax rates at both State and Central levels for the initial two years, which would be merged into a single tax rate in the third financial year.

FEATURES OF GST

- GST is a Destination based Consumption Tax.

- The place where the goods or services being consumed will be entitled to revenue from the transaction.

- For Example: If a dealer of Delhi sale goods to dealer of Punjab then tax will go to the credit of Punjab govt.

- GST in India is a dual based model i.e. state and central govt. will both levy GST termed as SGST and CGST respectively.

- The Central GST and State GST are to be paid to the accounts of the Centre and the States separately

- India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. Both the levels of Government have distinct responsibilities to perform according to the division of powers prescribed in the Constitution for which they need to raise resources. A dual GST will, therefore, be in keeping with the Constitutional requirement of fiscal federalism.

IMPACT OF GST ON TRADERS

Goods and Services Tax is a reality now. The only decision left in this regard is the roll–out date. It is the most significant tax reform in India since its independence. Once GST rolls out, it would have a significant impact on every segment of business entities be it traders, manufacturers, agents, etc. The Arvind Subramaniam Committee has proposed a rate of 18% for GST. This is a collective rate that will have two constituents, Central GST (CGST) & State GST (SGST) at 9% respectively.

Out of all the segments of the business entities GST will have far reaching impact on traders and would result in reducing the prices of the goods supplied by such traders.

In the pre-GST regime when a trader used to make inter-state purchase of goods he was charged central sales tax(CST) at the rate of 2% which was not allowed as the input credit when he sold those products in his own state. But in post-GST regime he shall be charged Integrated GST (IGST) on his inter-state purchases, the credit of which shall now be available against the tax liability incurred on the sale of goods. But the vital point is that any trader having an annual turnover of Rs 10 lakhs will have to file 3 monthly returns along with one annual return i.e. a total of 37 returns under GST regime which may prove to be heavy compliance cost. Let’s understand the situation of trader under the GST Regime by way of illustration.

For Example:

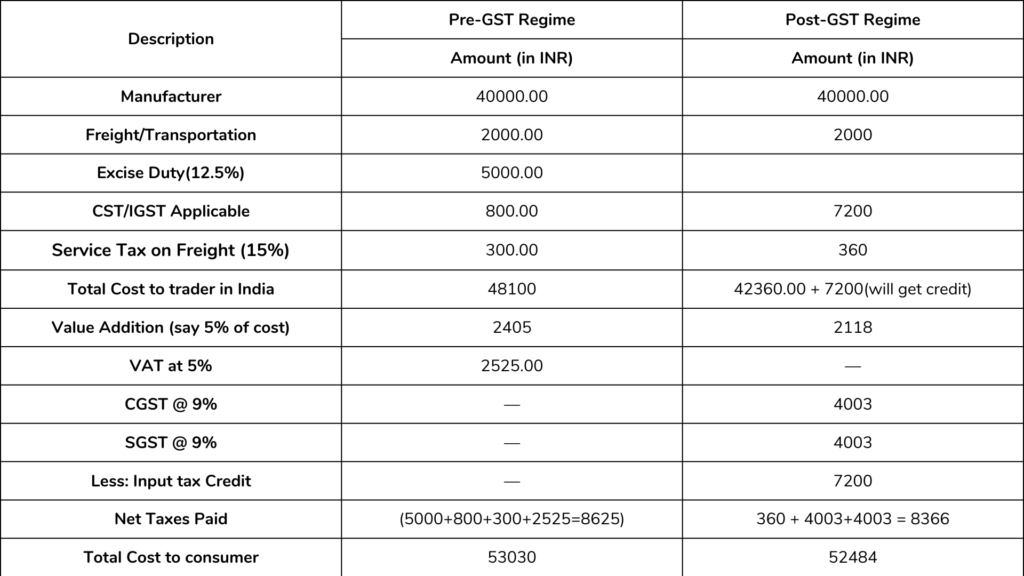

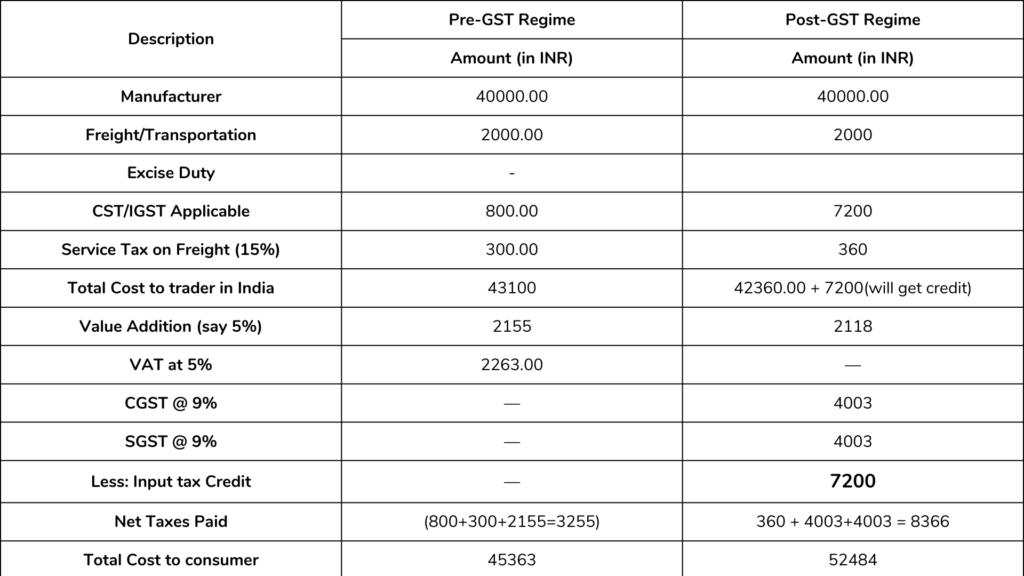

Below illustrations try to depict the possible scenario(s) after GST. It can be seen that the final consumer has to pay more than the current scenario. So it will lead to inflation. And possible decrease in demand as prices will be higher. Also the compliance cost of GST is also very high, it will add on to the cost of the goods/services.

Illustration 1: Suppose a trader in Delhi buys Rosin worth INR 40000 from a manufacturer in Hoshiarpur(excise duty is applicable)

Illustration 2: Suppose a trader in Delhi buy Rosin worth INR 40000 from a manufacturer in Hoshiarpur (excise duty is not applicable)

Related Blogs

Understanding GST and Its Impact on Rosin Industry

April 15, 2017 Understanding GST and its Impact on Rosin...

Read More